Get the free sdr1 form

Show details

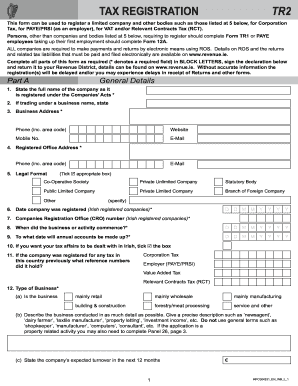

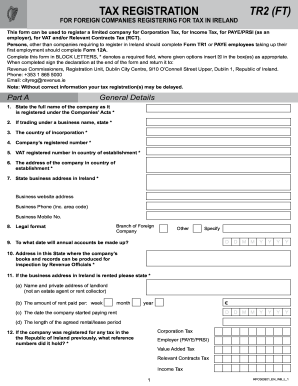

Helptext Form SDR1 What is Form SDR1 The SDR1 is the return for Conveyances Transfers Long Term Leases greater than 100 years of a Single Property You can obtain a Form SDR1 from Revenue s Forms and Leaflet s Service at LoCall 1890 306 706 or from any of our Stamp Duty offices in Dublin Cork or Galway. LoCall rates note that the rates charged for the use of 1890 LoCall numbers may vary among different service providers. Can I file this return on-line The most efficient way to completing the...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your sdr1 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sdr1 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sdr1 online

Follow the guidelines below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit sdr1 form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out sdr1 form

How to fill out sdr1:

01

Start by entering your personal information, such as your name, address, and contact details.

02

Next, provide information about your academic background, including your educational qualifications and any relevant certifications.

03

Fill in any work experience you have, including details about your previous jobs, roles, and responsibilities.

04

Include information about your skills and abilities, highlighting any specific competencies that are relevant to the purpose of the form.

05

If required, provide references who can vouch for your capabilities and character.

06

Double-check the form for any errors or missing information before submitting it.

Who needs sdr1:

01

Job applicants: Individuals who are applying for a job may be required to fill out an SDR1 form as part of the application process. The form helps employers gather necessary information about the candidates and evaluate their qualifications.

02

Students: Some educational institutions may ask students to complete an SDR1 form for various purposes, such as scholarship applications or enrollment in specific courses.

03

Government agencies: Certain government agencies may utilize the SDR1 form to collect data about individuals for various purposes, such as statistical analysis or regulatory compliance.

Video instructions and help with filling out and completing sdr1

Instructions and Help about sdr1 form

Fill form : Try Risk Free

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is sdr1?

SDR1 is a shortened term for Software Defined Radio (SDR) 1. It refers to the first version or iteration of a software-defined radio system. SDR allows for flexibility and reconfigurability of radio systems by implementing signal processing functionalities in software rather than hardware components. SDR1 would typically represent an earlier version or an initial implementation of such a system.

Who is required to file sdr1?

The specific requirements for filing SDR1 may vary depending on the jurisdiction. However, generally, SDR1 refers to the Self-Directed Retirement Plan Contribution Form 1, which is used by individuals or entities who have a self-directed retirement plan, such as a self-directed IRA or a solo 401(k). These individuals or entities may need to file SDR1 to report contributions made to their self-directed retirement accounts. It is recommended to consult with a tax professional or refer to the specific guidelines provided by the relevant tax authority to determine if filing SDR1 is necessary in a particular case.

How to fill out sdr1?

To fill out SDR1 (Standard Disability Report) form, follow these steps:

1. Gather the necessary information: You will need your personal and contact details, medical information, work details, and details about your condition and limitations.

2. Section A: Personal and Contact Information:

- Fill out your full name, Social Security Number, address, and contact information.

- Provide your date of birth, gender, and marital status.

3. Section B: Medical Information:

- Fill out your primary healthcare provider's contact details, including name, address, and phone number.

- Specify the names and contact information of any other healthcare providers involved in your treatment.

- Indicate the dates of your first visit, most recent visit, and next scheduled visit to your primary healthcare provider.

- Provide a brief explanation of your condition(s) and how they limit your ability to work.

4. Section C: Work Information:

- Mention your current employment status (employed, self-employed, unemployed), and provide details of your last job if you are currently unemployed.

- Describe your job duties and responsibilities.

- Highlight any job modifications or accommodations that were made due to your disabilities.

- Indicate the dates of your employment and the reason for leaving if you are no longer working.

- If applicable, provide information about any workers' compensation claims related to your disabilities.

5. Section D: Details about Your Medical Condition:

- List all medical conditions that limit your ability to work, the date each condition started, and the name of the healthcare provider who diagnosed it.

- Describe any symptoms, medications, treatments, or therapies you are receiving for each condition.

- Mention any hospitalizations, surgeries, or procedures related to your conditions.

- If you have had any medical tests or reports, include the dates and names of the facilities where they were conducted.

6. Section E: Details about Your Daily Activities:

- Describe your daily activities, including self-care, household chores, and social activities.

- Explain any difficulties you face and any help you need from others to perform these activities.

7. Section F: Contact Information of Someone Who Knows About Your Condition:

- Provide the contact information of a reliable person who knows about your condition(s) and its impact on your daily life.

8. Section G: Remarks:

- Use this section to provide any additional information or comments you think might be relevant to your disability claim.

9. Review and Sign the form:

- Make sure you have filled out all the required sections accurately.

- Read the declaration and sign and date the form.

10. Submit the Form:

- Make a copy of the filled-out form for your records.

- File the original SDR1 form with the relevant disability agency or organization, following their specified submission process.

Remember, it is crucial to provide complete and honest information while filling out the SDR1 form to ensure the accuracy of your disability claim. If unsure about any details, consult with your healthcare provider or contact the disability agency for assistance.

What is the purpose of sdr1?

There isn't enough context to provide a specific answer to what "sdr1" refers to, as it could have different purposes depending on the specific domain or field it belongs to. It could be a term used in various industries or contexts, hence a clear definition or purpose is required. Could you please provide more information or clarify the context in which you are referring to "sdr1"?

What information must be reported on sdr1?

SDR1 refers to a Suspicious Activity Report (SAR) that must be filed by financial institutions and other organizations to report known or suspected suspicious activities or transactions that may be linked to money laundering or other criminal activities. Some of the key information that must be reported on SDR1 includes:

1. Identifying information about the reporting entity: The name, address, and contact details of the financial institution or organization filing the SAR.

2. Information about the subject(s) of the report: Details about the individual or entity involved in the suspicious activity, such as their name, address, contact information, date of birth, social security number, or other identifying features.

3. Description of the suspicious activity: A comprehensive account of the suspicious activity or transaction, providing information on its nature, date, time, location, and any other pertinent details.

4. Supporting documentation: Supporting evidence or documents that substantiate the suspicious activity, such as bank statements, wire transfer records, account opening documents, or any other relevant financial records.

5. Transaction details: The specific details of the transaction, including the amount involved, the origin and destination of funds, any intermediaries involved, and any unusual or suspicious features of the transaction.

6. Law enforcement involvement: Information regarding any law enforcement agencies or regulatory bodies that have been informed or involved in the investigation of the suspicious activity.

It is important to note that the specific requirements for reporting on SDR1 may vary depending on the jurisdiction and the financial institution's internal policies and procedures.

What is the penalty for the late filing of sdr1?

The penalty for the late filing of SDR1 (Situation Determination Report 1) can vary depending on the jurisdiction and specific regulations in place. It is advisable to consult with the relevant regulatory authority or legal expert for accurate information regarding penalties for late filing of SDR1.

How can I edit sdr1 from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like sdr1 form, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I fill out the form sdr1 revenue commissioners form on my smartphone?

Use the pdfFiller mobile app to complete and sign sdr1 revenue form on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

Can I edit form sdr1 on an Android device?

With the pdfFiller Android app, you can edit, sign, and share sdr1 on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

Fill out your sdr1 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form sdr1 Revenue Commissioners is not the form you're looking for?Search for another form here.

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.